Navigating the EB-5 Regional Center Audit Process: A Comprehensive Guide

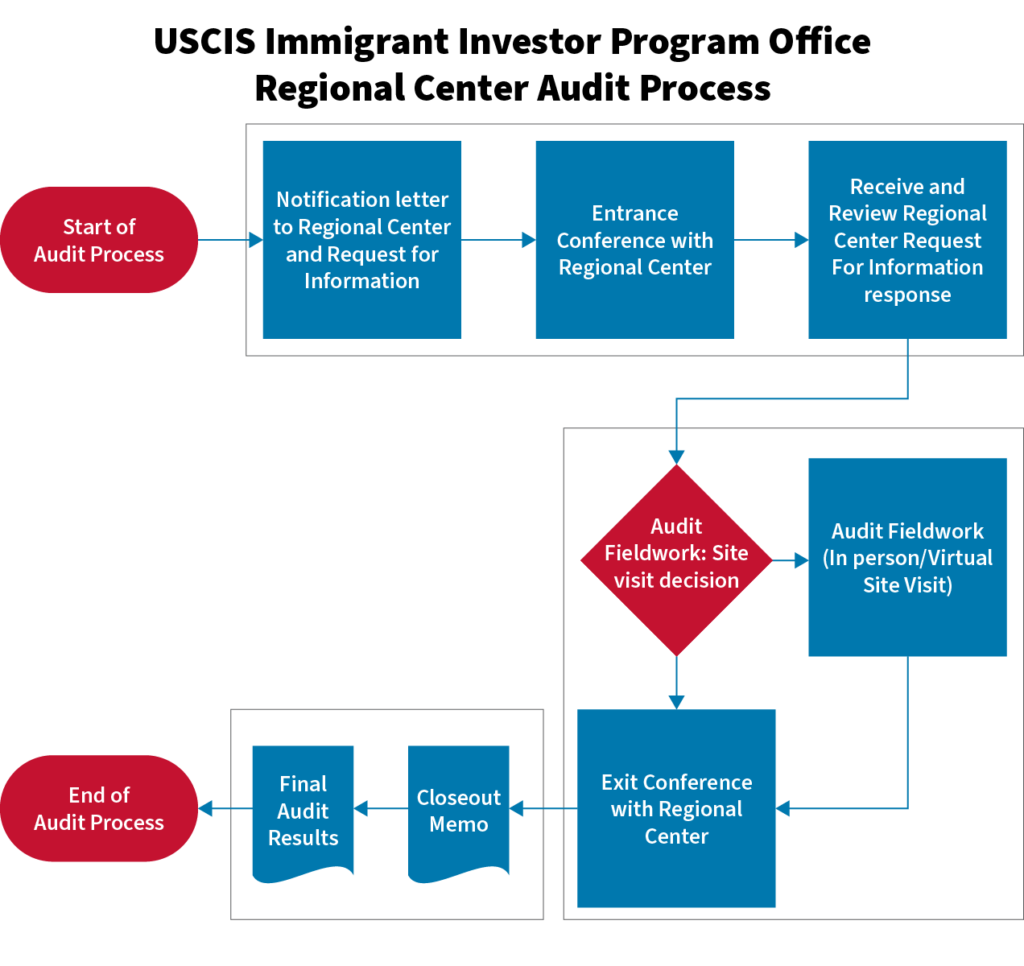

The EB-5 Immigrant Investor Program is vital for foreign investors seeking U.S. residency through investment. However, it is important to note that by statute, each designated regional center must be audited at least once every five years. This requirement ensures compliance and protects both investors and the integrity of the program. Following the 2022 EB-5 Reform and Integrity Act, USCIS has initiated regular audits of EB-5 Regional Centers, starting in 2024. The audit process can be complex and challenging, but insights from industry professionals who have experienced these audits provide essential strategies and considerations. This guide breaks down the audit journey into three main phases: pre-audit preparation, audit day, and post-audit follow-up, highlighting key tips and best practices at each stage.

Pre-Audit Preparation

Thorough preparation is crucial before any audit begins. Regional centers must proactively collect and organize essential documentation related to both investor details and project specifics. This includes a variety of documentation, such as:

- Investor Documentation: This encompasses subscription agreements, escrow letters, and fund administration agreements.

- Flow of Funds Documentation: Essential items include disbursement requests, wire confirmations, bank statements, and supporting invoices.

- Organizational Structure and Security Measures: Having an up-to-date organizational chart and understanding the authority structure within your center, as well as the IT platforms and their associated security measures, will help demonstrate compliance during the audit.

As the audit approaches, regional centers two notification letters from USCIS. The first serves as an official notice of the audit, while the second details the specific documentation required.

It’s important to note that regional centers typically have a very short two-week window to gather and submit these documents, which can create significant pressure. Therefore, clarifying documentation requirements early on is essential to ensure all team members are aligned and understand what is needed.

Additionally, an introductory phone call with USCIS can set a positive tone for the audit. This call allows regional centers to ask preliminary questions and clarify expectations, ensuring everyone is on the same page. Following this initial communication, a site visit may be scheduled, either in person or virtually, often with little notice.

Key Audit Focus Areas

During the audit, USCIS will focus on several key areas:

- Financial Records and Fund Flows: USCIS will review five years of financial records to ensure that investor funds are properly allocated to job-creating projects. Documentation such as transaction logs and annual reports must be kept up to date to demonstrate compliance.

- Project Management and Oversight: USCIS will scrutinize how Regional Centers manage and oversee their projects, ensuring compliance with EB-5 regulations. This involves verifying investment accuracy, job creation metrics, and the overall management processes.

- Site Visits and Employee Interviews: USCIS may conduct on-site visits to verify the physical operations of Regional Centers. Officials will interview key employees to assess their roles, responsibilities, and understanding of compliance requirements.

- Challenges of Multi-Center Operations: For operators managing multiple Regional Centers, each will be audited separately. This requires distinct documentation for each center, emphasizing the importance of meticulous record-keeping across operations.

Audit Day

On the day of the audit, regional centers must present their preparedness and professionalism. It is essential to identify the USCIS personnel present and ensure that key team members, including legal counsel, are available to address inquiries. Fostering a cooperative atmosphere can transform what might feel like an interrogation into a collaborative effort.

To enhance the experience for both auditors and regional centers, preparing a concise 5-6 slide presentation is advisable. This presentation should cover:

- The history of the regional center

- The ownership structure

- Unique aspects of your operational model

- Any additional relevant information to set the stage for the audit discussion

Organizational skills are critical on audit day. Auditors will assess how well documentation is maintained and whether it is readily accessible. It’s crucial to demonstrate effective document management and Avoid having empty folders. Empty folders can indicate disorganization and may raise red flags during the audit, as auditors often conduct spot-checks to evaluate data maintenance.

Post-Audit Considerations

Once the audit concludes, regional centers may receive follow-up requests for additional documentation, commonly referred to as “homework.” Timely and thorough responses to these requests are essential for maintaining a positive relationship with USCIS. Participating in post-audit feedback sessions provides an excellent opportunity to discuss experiences and offer constructive suggestions for improving future audit processes.

Being prepared to recap any documentation that emerged during the audit is also vital. This ensures that auditors have all necessary records for their files, demonstrating the regional center’s commitment to compliance.

Best Practices

To enhance the audit preparation process, consider implementing the following best practices:

- Conduct Regular Internal Audits: Frequently check records, reports, and operations to ensure they align with USCIS requirements. Addressing discrepancies early can prevent complications during official audits.

- Provide Compliance Training and Communication: Train staff on EB-5 regulations and audit processes to ensure they can accurately answer USCIS questions. Regular communication about audit requirements will help prepare employees for their roles.

- Allocate Sufficient Resources: Ensure that adequate resources, including IT support and legal guidance, are available to facilitate timely and efficient responses during the audit period.

Conclusion

In conclusion, it is essential to remember that every designated regional center is required to undergo an audit at least once every five years. This requirement underscores the importance of compliance and diligence in maintaining the integrity of the EB-5 program. While audits present challenges, they also offer opportunities to enhance transparency and improve internal controls. By preparing thoroughly, regional centers can strengthen their compliance with EB-5 requirements, boost investor confidence, and ensure long-term success in the program.

For more detailed information regarding the audit process, you can visit the USCIS official page on EB-5 Regional Center Audits.